Welcome back to the Ponzi Papers, where we’ve been building a growing body of evidence of the largest criminal theft in human history, currently in progress.

You can find links to previous posts at the bottom, but I’ll be providing the context you need as we go. Here’s the backstory to get you up to speed:

Every major cryptocurrency exchange was participating in the same decentralized Ponzi scheme orchestrated over multiple decades, with investments from a whole host of tech venture capitalists and very powerful people.

This fraud was built on top of existing global criminal networks that have been in place for decades, though digital currency and internet technology allowed them to replicate and grow to new heights. You know a bit about this crime network because one of the masterminds and financiers was Jeffrey Epstein, who also ran an international blackmail ring to keep people in line and make a tidy profit wherever possible.

You also know about these networks because they’ve permeated our daily existence online, in the media, and in some of the highest political offices.

This isn’t metaphor or theory; hyperbole or speculation: Ruthless con artists and violent criminals have gained totalitarian control of our world and I believe that’s something you ought to know.

And they’ve escalated their crime dramatically in recent months, intentionally collapsing Silvergate, Silicon Valley Bank, Signature, Credit Suisse, and First Republic as they funneled stolen cash out of them.

--

The reason I am certain this theory isn’t the result of delusion or psychosis or good ol’ stupidity is that it is repeatedly able to explain things that are inexplicable in our conventional narrative, even things that didn’t occur until after the theory was established. This thing has explanatory power for days. Let’s pull some fresh examples from the headlines to see what I mean.

Last Sunday, the New York Times ran a puff piece on Elizabeth Holmes, the criminal founder of Theranos out of Stanford. Conventional wisdom is that this woman conned some of the most powerful and connected people on the planet, so why would a newspaper that supports those same people ever run a piece like this? It’s completely antithetical to what they tell us is true (It’s also strange how they never call this a Ponzi scheme even though that’s what this would be).

In this tall tale of mine, her famous and powerful investors were actually in on it, investing their cash into global criminal networks to fund things like a decentralized cryptocurrency Ponzi scheme. In my story, this article makes a hell of a lot more sense, doesn’t it? She’s their secret crime buddy so they’re giving her the spotlight.

--

Last week, the public learned that LinkedIn co-founder Reid Hoffman visited Epstein’s island in 2015. I’m sure most people don’t know much about Hoffman, but also that they hadn’t made any association between him and Epstein. In my theory, Reid Hoffman and Jeffrey Epstein are long-time co-conspirators in the same criminal scheme in 2015, which would certainly explain the island visit.

The week prior, The Wall Street Journal reported Epstein’s meetings with Harvard professors Noam Chomsky and Martin Nowak. The public has Epstein in some university orbits, but my theory has him participating in the same massive theft with Harvard University and many of its professors developing Ponzi schemes together, often around the futurist technology that Epstein was apparently discussed with these professors.

--

For our main course, PayPal disclosed almost $1 billion of crypto on its balance sheet on Tuesday, a 53% increase over the previous quarter. I suppose the popular wisdom would be that PayPal believes in the value of crypto as an asset, which is also why they allow buying and selling of crypto on their platform. But this theory holds that PayPal is doing exactly what Sam Bankman-Fried and FTX did right in front of us, and that its inevitable collapse was the plan all along.

What’s PayPal’s role in this story so far?

First, it was founded by several graduates of Stanford, which helped birth fraudulent companies Clinkle, FTX and Theranos, as discussed in Part 2 (If you’d like more evidence of the Stanford crime factory, check out the top all-time post in the school’s subreddit).

Second, those founders include Peter Thiel, whose venture capital firm played an integral role in the development of the global cryptocurrency Ponzi scheme, as discussed in Part 4, along with the SVB bank run. Several of PayPal’s founders used a tax loophole to stash billions in Roth IRAs; Thiel learned this from Stanford professor Joseph Bankman, father of crypto criminal Sam Bankman-Fried.

Another PayPal founder you may know is Elon Musk; though I haven’t explored Musk’s role in all of this deeply, it’s worth noting that he is an incessant crypto shill; the Boring Company looked a whole lot like a Ponzi scheme; and his comically poor handling of Twitter would be the perfect cover to destroy one of the largest communication platforms in the world.

Reid Hoffman, the LinkedIn guy who visited Epstein’s island, was one of PayPal’s founding board members. If you’re getting the hang of this story, you will be unsurprised to learn that he went to Stanford University and is a partner at Greylock Partners, a crypto venture capital firm.

--

Let’s have a look at PayPal’s stock chart over the last few years. Even if you’re not familiar with stock charts, does anything stick out to you?

Is it that 300% rise and even faster fall from 2020 to 2022?

Or maybe you’re looking at the trading volume in blue and see that it suddenly more than doubled in late 2021 just as the price fell off a cliff, echoing the bitcoin volume spikes in Part 4? As you might surmise, these are not typical trading patterns.

--

Here is another chart for you: This is the price of Bitcoin since 2020, which increased over 500% at its peak, with a couple dates highlighted:

That first date, the last sharp pump before the top, was when financial services company Affirm Holdings announced they would allow crypto trading.

What does Affirm have to do with PayPal and this story more broadly? It was founded by PayPal co-founder Max Levchin in 2012, later partnering with Theranos mega-investor Walmart and NYU mega-donor Jeff Bezos. They also partnered with payment processor Stripe, which has investments from Elon Musk, Peter Thiel and crypto VCs Sequoia Capital and Andreessen Horowitz.

In 2020, it had a staggering list of investors that included several tech VCs, Stanford grads, and random billionaires, much like Clinkle in Part 1.

And much like PayPal, Affirm has a very suspicious stock chart; with this one’s high-frequency trading kicking into gear just before the announcement:

So the first day on the previous Bitcoin chart is Affirm pumping the crypto market with their news. The second day, which is the third highest Bitcoin price of all time, was the exact day PayPal started their high-frequency trading frenzy. A nice little inter-company pump-and-dump.

--

What are we to make of this?

First, a quick recap of how Sam Bankman-Fried and FTX’s Ponzi scheme worked. Victims would buy crypto in cash through the FTX trading firm. FTX would then move that cash into their investment firm, Alameda Research, replacing the cash with their worthless crypto token. Eventually, the exchange runs out of money and the Ponzi scheme is exposed, the cash long disappeared through a network of offshore banks and shell companies.

PayPal, it turns out, is doing the exact same thing. The 2020 stock surge was PayPal collecting its cut from the crypto Ponzi scheme, likely directly through its partnerships with crypto exchanges.

After the affiliated company Affirm gives the crypto market a big pump, PayPal starts funneling out the cash and replacing it with worthless crypto, just like FTX.

When the crypto market collapses and PayPal goes insolvent, we’ll learn that they’ve replaced a whole lot more of their stolen cash with crypto, another bad investment from the people who somehow just keep getting richer and more all-encompassingly powerful.

--

There is a counterargument to the above that may have occurred to you: Sure, that PayPal chart isn’t normal, but that was during COVID! The entire tech sector was out of control when we were all locked inside buying Pelotons and stuff. If PayPal’s rise and fall was because they were bloating the company with stolen crypto money before draining it, then why did all those other companies surge as well?

Though I haven’t explored any of these companies in the detail I’ve covered PayPal, let’s gather some fast facts on just a handful of them:

Zoom stock increased 800% before falling back to pre-COVID levels. Their first ever customer was Stanford University in 2012. In 2017, they raised $100 million from major crypto VC Sequoia Capital.

Peloton saw a similar 800% increase before falling to a fraction of its 2019 levels. Their biggest investor is Bullish, which recently released a report out of the Cayman Islands about the rise and staying power of cryptocurrency. Their second biggest is Tiger Global Management, which has made massive investments in blockchain technology, and had a $38 million stake in FTX.

Snap, Inc., the owner of Snapchat, had a 700% rise and fall. Their investors include Lightspeed Ventures, Spark Capital, and Fidelity Investments, all of whom invested in Affirm, along with Tiger Management spinoff Coatue.

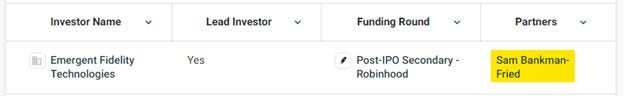

Stock trading platform Robinhood began offering their stock publicly in late 2021 and has since fallen to roughly one-tenth of its peak. It was founded by two students out of Stanford and was invested in by Affirm investors Ribbit, Sequoia, Thrive and Andreessen Horowitz. But their crypto connections are best shown through a screenshot of their Crunchbase investor page:

--

In Part 4, we discussed some of the technical workings of cryptocurrency as a new type of decentralized Ponzi scheme, allowing exchanges on opposite sides of the planet to participate in the scam together.

It appears that the COVID tech bubble is just another part of the decentralized Ponzi scheme. In the past, publicly listed Ponzi schemes would involve one company that cash was invested into and funneled out of. Now, this criminal network has such expansive holdings in the industry and has developed a Ponzi scheme of such astronomical size, that it seems they have funneled the criminal profits through all of these well-known companies.

But if these companies have been used largely to collect their Ponzi profits and funnel them away, then these companies will need to justify massive layoffs or even bankruptcy like Clinkle and the Metaverse did. They could all just replace their cash with Bitcoin and then pull the crypto rug, but that probably makes less sense for Opendoor and Rivian than it does for PayPal, which buys and sells crypto. Plus, it might look awfully suspicious if half of Silicon Valley goes under because they’ve got crypto on the books.

So what’s the exit strategy? How do they complete the scheme once they’ve drained these companies? This is just speculation, but let’s call it a strong hunch based on everything I’ve learned about these people. Did you hear about this week’s revelations that Congressional super-fraud George Santos has surprisingly strong ties to FTX? Tough to explain, right?

But we know that Sam Bankman-Fried and Peter Thiel have donated massive sums to American politicians in both parties. And the cryptocurrency media apparatus has been working overtime to sow fear about the economy since they collapsed five banks this year.

Well what happens if the U.S. doesn’t reach an agreement on the debt ceiling and the U.S. defaults on its debt? It’s hard to know for sure, but as the Brookings Institute notes: “Even in a best-case scenario where the impasse is short-lived, the economy is likely to suffer sustained—and completely avoidable—damage.” If that kind of damage is hitting the entire economy, surely you’d expect some tech companies that got a little too big for their britches to fail, right? The perfect cover.

But could they pull it off? Of the 100 senators voting on raising the debt ceiling, imagine they’ve got just four senators in on the scheme; two in each party. If these four secretly sowed fear, uncertainty, and doubt among their parties and kept each other updated on the other side’s plans, could they pull it off? In this hauntingly partisan political climate? Seems possible.

Then remember that Donald Trump is the quintessential celebrity billionaire salesman, and that his son-in-law Jared Kushner is directly implicated in this scheme of celebrity billionaire salesmen.

And remember that Bill Clinton shilled for Elizabeth Holmes, shared the stage with Bankman-Fried at Crypto Bahamas, and flew on Jeffrey Epstein’s plane at least 26 times.

So, yeah. I think it’s more than four senators.